The tech world is buzzing, and Nvidia is at the center of it all. The company, once known primarily for gaming GPUs, has evolved into a powerhouse driving advancements in artificial intelligence, data centers, and autonomous vehicles. With its cutting-edge chips becoming the backbone of AI infrastructure, Nvidia’s growth potential is staggering. Recent earnings reports have smashed expectations, proving that demand for its products isn’t slowing down. For investors looking to capitalize on the AI revolution, there’s no better time than now to consider adding Nvidia stock to their portfolio.

Nvidia’s dominance in AI hardware is unmatched. Its A100 and H100 GPUs are the gold standard for machine learning and deep learning applications, used by tech giants like Microsoft, Google, and Amazon. The rise of generative AI—think ChatGPT and Midjourney—has only fueled demand for Nvidia’s high-performance chips. Even as competitors scramble to catch up, Nvidia continues to innovate, with its upcoming Blackwell architecture promising even greater efficiency and power. This technological lead gives the company a moat that’s hard to breach, making it a safe long-term bet.

Beyond AI, Nvidia is expanding into new markets. Its Omniverse platform is revolutionizing 3D design and simulation, while its automotive division is making strides in self-driving technology. Partnerships with major car manufacturers ensure that Nvidia’s DRIVE platform will be a key player in the future of transportation. Additionally, the company’s data center business is booming, as cloud providers and enterprises invest heavily in AI-ready infrastructure. This diversification means Nvidia isn’t reliant on a single revenue stream, reducing risk for investors.

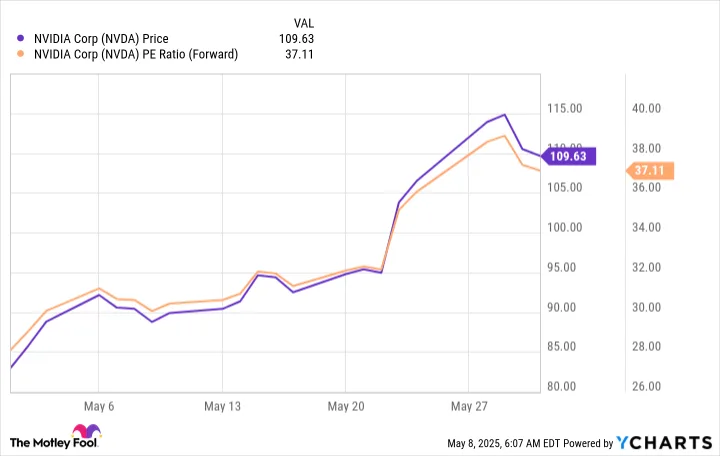

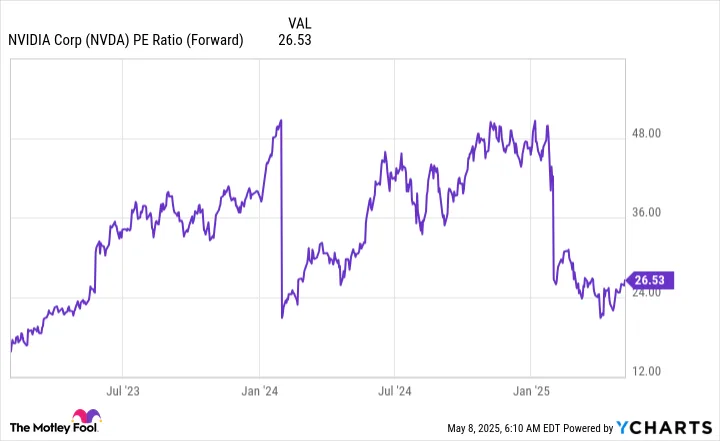

Financially, Nvidia is firing on all cylinders. Revenue has skyrocketed, with data center sales now eclipsing its gaming segment. Gross margins remain strong, reflecting the premium pricing power of its products. Even more impressive is its ability to convert sales into profits, with net income growing at an explosive rate. While some worry about valuation, Nvidia’s growth trajectory justifies its premium. Analysts continue to raise price targets, with many predicting the stock has room to run as AI adoption accelerates worldwide.

Market sentiment is overwhelmingly bullish. Nvidia’s stock has already seen massive gains, but industry experts believe this is just the beginning. The AI boom is still in its early stages, and Nvidia stands to benefit more than almost any other company. Short-term pullbacks could happen, but for investors with a multi-year horizon, these dips should be seen as buying opportunities. With strong leadership under CEO Jensen Huang and a relentless focus on innovation, Nvidia is well-positioned to maintain its dominance.

Nvidia Faces a $5.5 Billion Writedown in Q1—But the AI Boom Isn’t Slowing Down

Nvidia’s first-quarter earnings report came with a notable setback: a $5.5 billion writedown due to U.S. export restrictions on high-end AI chips to China. The sudden policy shift left the company with a pile of advanced semiconductors it could no longer sell in one of its largest markets, denting its Q1 financials. While this writedown is significant, it’s a one-time hit—not a recurring problem. Still, the ongoing trade restrictions could weigh on future sales in China, forcing Nvidia to adapt its strategy in the region.

Despite this challenge, demand for Nvidia’s AI chips remains red-hot. Major cloud providers—Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Meta—have all reaffirmed their massive capital expenditure plans for AI data centers in their own Q1 earnings calls. These tech giants are pouring tens of billions of dollars into AI infrastructure, and Nvidia’s GPUs are at the heart of their expansions. Even with macroeconomic uncertainties, including potential tariffs under a second Trump administration, hyperscalers aren’t pulling back on spending. That’s a strong signal that Nvidia’s growth story is far from over.

The China export restrictions, while disruptive, haven’t derailed Nvidia’s momentum. The company has already developed modified versions of its chips to comply with U.S. regulations, ensuring it can still serve Chinese customers—albeit with slightly less powerful hardware. Meanwhile, demand from American and European AI firms is so intense that Nvidia’s biggest problem right now isn’t finding buyers—it’s keeping up with orders. The backlog for its latest AI accelerators stretches months out, reinforcing the company’s dominant position in the market.

Financially, the $5.5 billion writedown will make Q1 earnings look weaker than usual, but investors should focus on the bigger picture. Nvidia’s data center revenue—now its largest segment—continues to surge, offsetting any softness in China. Gross margins remain near record highs, proving that Nvidia can maintain premium pricing even in a shifting regulatory landscape. Analysts expect the company’s earnings to rebound quickly, with AI spending acting as the primary growth driver.

Looking ahead, Nvidia’s biggest risk isn’t weak demand—it’s supply constraints. The company relies heavily on TSMC for chip production, and any delays in manufacturing could temporarily slow sales. However, with AI adoption still in its early innings, Nvidia’s long-term outlook remains extremely bullish. The $5.5 billion writedown is a short-term hurdle, not a structural flaw in the business.

For investors, the key takeaway is this: Nvidia’s growth is being fueled by an unstoppable AI boom, and temporary headwinds won’t change that. While the China situation is worth monitoring, the sheer scale of global AI investment ensures Nvidia will remain a top performer. If the stock dips on the Q1 writedown news, it could be a buying opportunity rather than a reason to panic. The AI revolution is here, and Nvidia is still leading the charge.nd then some.

In conclusion, Nvidia represents a rare opportunity to invest in a company that’s not just riding a trend but defining it. AI is reshaping industries, and Nvidia’s chips are the engines powering that transformation. Whether you’re a growth-focused investor or someone looking for stable long-term returns, Nvidia stock deserves serious consideration. The time to buy is now—before the next wave of AI advancements sends the stock even higher. Don’t wait for the crowd to catch on; the future is here, and Nvidia is leading the charge.